Zimbabwe’s Real Estate Investment Trust (REITs) market continues to grow, driven by expanding urbanisation, strong demand for real estate properties and regulatory support.

However, the future of REITs in the country faces both challenges and opportunities, according to financial analyst Takudzwa Kudenga and real estate expert Sheila Muzonde.

Kudenga said growing urbanisation and the expanding middle class had provided a strong foundation for the REITs sector.

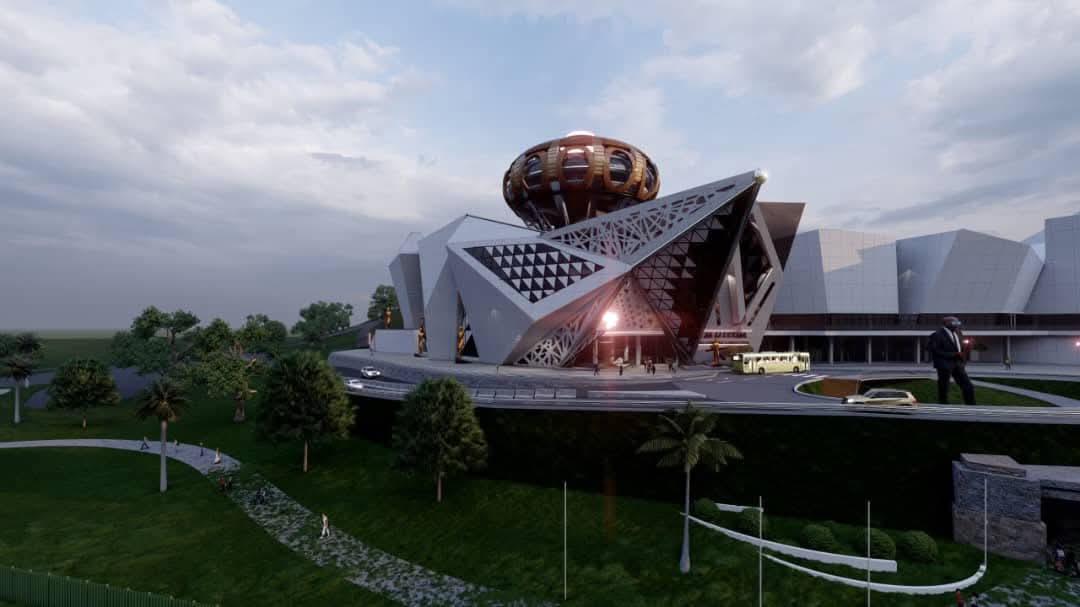

“Zimbabwe’s urban centers are experiencing notable growth of population, leading to higher demand for both residential and commercial properties.

“This is driving up rental yields for urban-centric REITs,” he stated.

Kudenga said this trend was favourable for REITs investors looking for stability in a sometimes volatile economy. He also noted that the Government’s supportive regulatory framework had been beneficial.

“The Zimbabwean Government’s tax incentives, especially the tax exemptions on income distributed by REITs, have made these investments more attractive to investors.

“This support from policymakers has the potential to propel REITs forward as a major segment within the country’s real estate landscape,” he said.

Muzonde highlighted the importance of quality and diversification in property portfolios.

“Zimbabwe’s REITs currently focus on urban commercial properties because of the higher rental yields associated with urbanisation,” she noted.

“This focus on quality, well-located properties not only enhances income stability over time but also reduces risks tied to specific locations.”

Muzonde believes that diversification is crucial for Zimbabwean REITs.

“As these REITs mature, further acquisitions and portfolio diversification, perhaps into sectors like industrial real estate will help them weather economic cycles better,” she added.

One of the key areas Zimbabwean REITs have been working on is upgrading existing commercial spaces. According to Kudenga, this trend aligns with global REIT practices.

“Redeploying capital to improve shopping centers and office spaces is a proven strategy to increase rental yields. Zimbabwean REITs are already moving in this direction, which is promising for future returns,” he added.

Muzonde added that tenant quality plays a critical role in the success of REITs, given the importance of stable, long-term rental income.

“Reliable and creditworthy tenants, such as Government agencies and multinational corporations, are pivotal for Zimbabwe’s REITs. These entities have a lower risk of default, ensuring steady rental income and reducing vacancy risks,” She said.

This strategy of targeting robust tenants is crucial as it minimizes income volatility for investors.

Both Kudenga and Muzonde believe that while the REITs market in Zimbabwe has significant growth potential, the market requires a vigilant approach due to economic challenges.

Kudenga cautioned “Investors must stay aware of potential economic shifts or regulatory changes that could impact valuations and income.”

The REIT market in Zimbabwe appears poised for growth, but its success will depend on strategic diversification, quality improvements, and maintaining a keen eye on regulatory and economic conditions.