The Zimbabwean residential real estate market is undergoing a period of dynamic, albeit complex, evolution. Projections indicate a substantial valuation, with estimates placing the market at US$85.35 billion by 2025. This growth, however, is occurring within an economic landscape characterized by both opportunities and significant challenges.

One of the primary drivers of this market activity is the persistent demand for urban housing. Zimbabwe’s urban centers, particularly Harare, are experiencing rapid population growth, leading to a surge in the need for residential properties. This demand is further amplified by the presence of diaspora remittances, which play a crucial role in fueling property purchases. Additionally, the tendency for investors to view real estate as a safe haven against economic instability further boosts market activity.

However, several factors are constraining the market’s full potential. The availability of affordable financing remains a significant hurdle. High-interest rates and stringent mortgage requirements limit access to homeownership for a large portion of the population. Furthermore, the volatility of the Zimbabwean economy, marked by fluctuating currency values and inflationary pressures, creates an environment of uncertainty.

Construction costs are also a major factor influencing property prices. The rising cost of building materials, often driven by imports and currency fluctuations, contributes to the overall expense of residential development. This, in turn, impacts the affordability of housing for potential buyers.

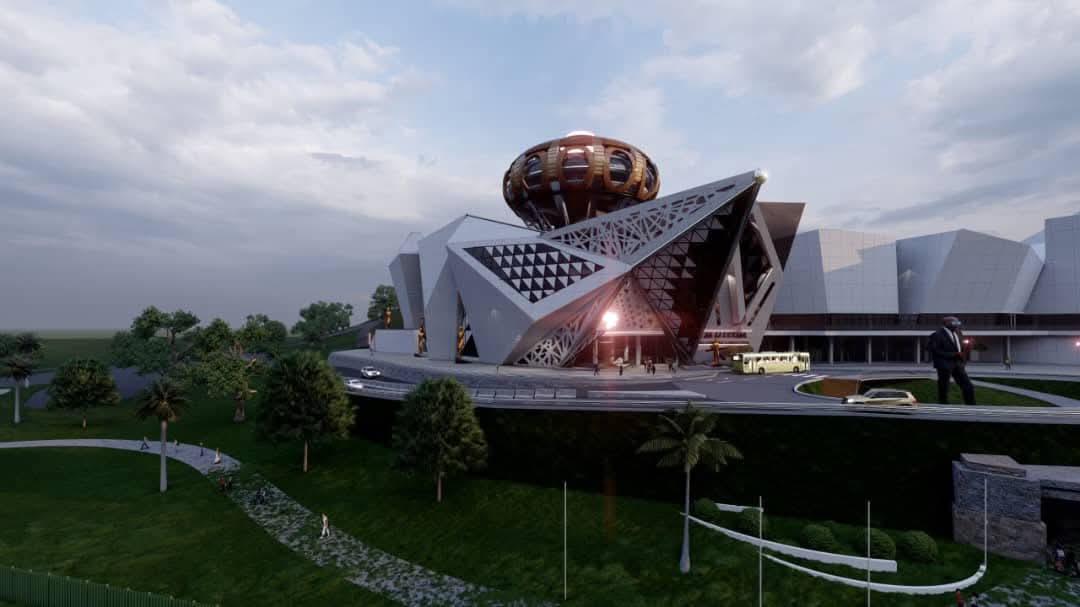

Despite these challenges, there are pockets of growth and opportunity. The demand for properties in secure, well-located areas remains strong, and there is a growing interest in modern residential developments. Furthermore, the use of the US dollar in real estate transactions provides a degree of stability, which is attractive to both local and foreign investors.

Moving forward, the trajectory of Zimbabwe’s residential real estate market will depend on the interplay of these various factors. Addressing the challenges related to financing, construction costs, and economic stability will be crucial for unlocking the market’s full potential and ensuring that housing remains accessible to a wider segment of the population