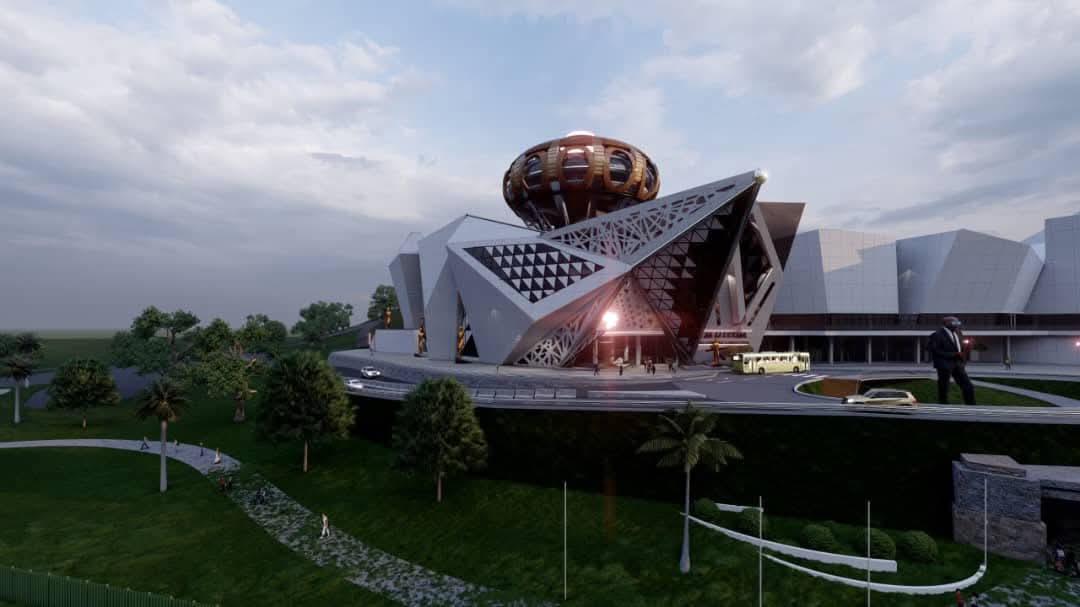

Zimbabwe’s prominent clay brick manufacturer and distributor, Willdale Limited, has ushered in a new era with the appointment of Brian Mataruka as its board chairman. This leadership change comes as the Zimbabwe Stock Exchange-listed company sets its sights on a robust recovery following a challenging 2024 financial year marked by liquidity constraints, moderate inflation, and heightened market competition.

The company acknowledges the complexities of the operating environment, including the introduction and subsequent devaluation of the local currency, which presented hurdles. Looking ahead to 2025, Willdale anticipates continued tight liquidity and intensifying competition as both established and new players vie for projects within the construction sector.

Despite these challenges, Willdale remains optimistic, buoyed by the ongoing boom in the construction industry. The company intends to leverage its strong brand reputation and consistent focus on producing high-quality products to maintain a competitive edge in the market.

A key strategic initiative for 2025 is the ambitious US$3.5 million investment in an all-weather brick-making plant. This significant project is poised to revolutionize Willdale’s production capabilities, enabling year-round brick manufacturing, a departure from the traditional seasonal limitations imposed by sun-drying methods prevalent in the industry. The company looks at ensuring a consistent supply of bricks throughout the year, which is expected to enhance its service delivery to clients and capitalize on the sustained demand from the construction sector. Funding for this crucial plant acquisition is reportedly in advanced stages.

The new board, under Mataruka’s chairmanship, is committed to supporting the government’s infrastructural development agenda by ensuring the consistent availability of high-quality bricks. Recognizing the importance of operational efficiency, Willdale is actively streamlining its operations to reduce costs and enhance overall productivity, thereby strengthening its resilience in a competitive landscape that includes Chinese-owned brick manufacturing companies. The board also appreciates the government’s recent efforts to stabilize the exchange rate, particularly as state-related institutions constitute a significant portion of Willdale’s clientele for face bricks. Exchange rate volatility had previously posed financial challenges, making the acceptance of local currency payments less viable.

Furthermore, Willdale is strategically exploring opportunities presented by its substantial land holdings. The company has engaged land developers to potentially convert portions of its land bank into commercial and residential developments, unlocking additional value and diversifying its revenue streams.

Sustainability and environmental responsibility are also high on the new board’s agenda. Recognizing the significant energy consumption associated with coal usage in brick manufacturing, Willdale is committed to exploring sustainable practices and mitigating its carbon footprint through initiatives aimed at achieving a carbon balance. Environmental, social, and governance (ESG) considerations will be integral to the board’s strategic decision-making.

Additionally, Willdale is engaging with the Treasury regarding value-added tax issues, particularly concerning the commercialization of its land assets, to ensure a favourable operating environment for its diversification plans. The overarching vision is to build a resilient and sustainable business that contributes significantly to Zimbabwe’s infrastructure development while embracing responsible practices and exploring new avenues for growth.