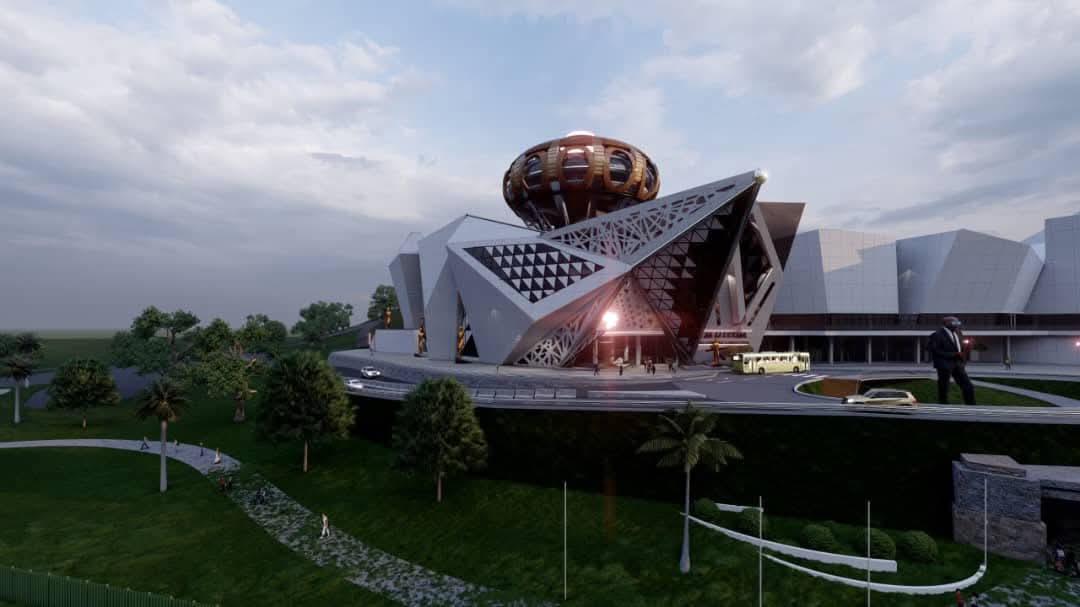

WestProp Holdings Limited is offering a novel approach to dividend payments, giving shareholders the choice between cash and new “10% non-redeemable participating preference shares.”

This innovative strategy aims to retain cash within the company to fuel its ambitious development projects, according to property consultant Kura Chihota.

The dividend, amounting to 83.33 US cents per ordinary share, can be received as a cash payment or in the form of these new shares, each with a nominal value of US$5. This decision follows the company’s 2023 IPO, which listed 30 million ordinary shares and 6 million preference shares.

The board’s decision aligns with the company’s constitution and the Companies and Other Businesses Act, empowering them to offer scrip dividends. Shareholders approved this scrip dividend option at the Annual General Meeting held on May 3, 2024. The total value of reserves to be capitalized for this dividend is a substantial USD 25 million.

Shareholders must choose either the cash or the scrip option; partial selection is not available. The dividend payment, whether in cash or shares, is expected around February 28, 2025. Shareholders should be aware that applicable shareholders’ tax will be deducted from gross dividends.

Detailed information regarding the scrip dividend offer will be sent to shareholders on February 10, 2025. The company has advised shareholders to ensure their mailing details are up-to-date with Corpserve Registrars.

This strategic move by WestProp allows shareholders to participate further in the company’s growth while simultaneously bolstering WestProp’s financial capacity for development.