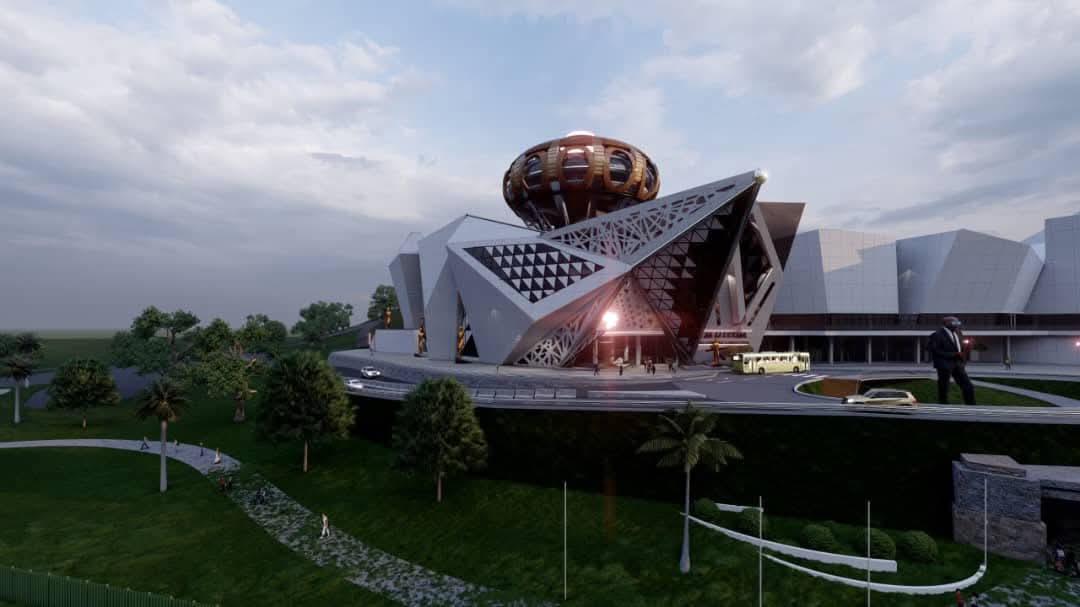

Masimba Holdings Limited says its order book remains robust and diversified, positioning the construction company for sustained growth despite some challenges in the operating environment.

In its trading update for the quarter ended September 30, 2025, the company said revenue rose by 16 percent to US$16,6 million, buoyed by stronger execution of projects in both the public and private sectors.

Masimba’s board believes the current order pipeline demonstrates a healthier balance between Government and private contracts, reflecting the success of its diversification strategy.

“The group’s order book remains strong and is progressing well in terms of diversification, with an improved balance between public and private sector projects,” the company said.

The firm noted that business conditions were supported by a relatively stable macroeconomic environment, marked by declining inflation and a resilient local currency.

Month-on-month inflation averaged 1,4 percent for the year to date, while the Zimbabwe Gold (ZiG) exchange rate depreciated only 3,3 percent between December 2024 and September 2025.

Analysts say this stability has given companies room to plan better and manage costs. Masimba, which operates in construction, engineering, and infrastructure development, reported that its tighter working capital management and improved liquidity helped sustain operational efficiency during the quarter. Its current ratio strengthened to 1,37 from 1,23 last year, signalling improved short-term financial health.

“The group remains proactive in managing and optimising its working capital to sustain operational efficiency and financial stability,” Masimba said.

Although net profit after tax was still 7 percent below the previous year at US$5,7 million, management said the performance represented a strong recovery from the 20 percent shortfall reported at the half-year.

The rebound follows a difficult first quarter, when an unusually prolonged rainy season delayed project rollouts. The company responded with intensified revenue-generation efforts in subsequent quarters, allowing year-to-date revenue to recover to 2024 levels.

Market watchers note that Masimba’s financial resilience has become a key differentiator within the local construction industry, where liquidity shortages and delayed payments from public sector clients often weigh heavily on performance.

Masimba also underscored its commitment to high operational standards and employee safety. The group maintained its certification across key International Standards Organisation (ISO) frameworks — ISO 9001:2015 for Quality Management, ISO 14001:2015 for Environmental Management, and ISO 45001:2018 for Occupational Health and Safety.

The company achieved a Lost Time Injury Frequency Rate (LTIFR) of zero during the quarter, matching last year’s record.

Industry observers say maintaining such standards enhances Masimba’s competitiveness when bidding for both local and regional projects.

Looking ahead, Masimba expects Zimbabwe’s economy to remain relatively stable through year-end, with GDP projected to grow by 6,5 percent, supported mainly by a recovery in the mining sector.

The Government’s continued investment in infrastructure is also expected to sustain project activity across transport, energy, and water sectors.

“The group therefore expects to remain profitable and maintain its growth trajectory, anchored by expansion in the mining sector and continued infrastructure investment by the Government,” the company said.

With a strong order book and growing participation from private clients, Masimba appears well-placed to capture new opportunities in 2026.

Additionally, a diversified client base could protect the company from cash flow pressures associated with delayed public sector payments, while providing exposure to more profitable private contracts.

Despite persistent challenges around liquidity and access to local currency, the company’s disciplined financial management and focus on safety, quality, and efficiency continue to underpin its operations.

Masimba’s strategy of balancing public and private work streams, alongside its ISO-certified processes, has helped it maintain momentum in a competitive market, offering confidence that growth will be sustained into the next financial year.