By Martin Chemhere

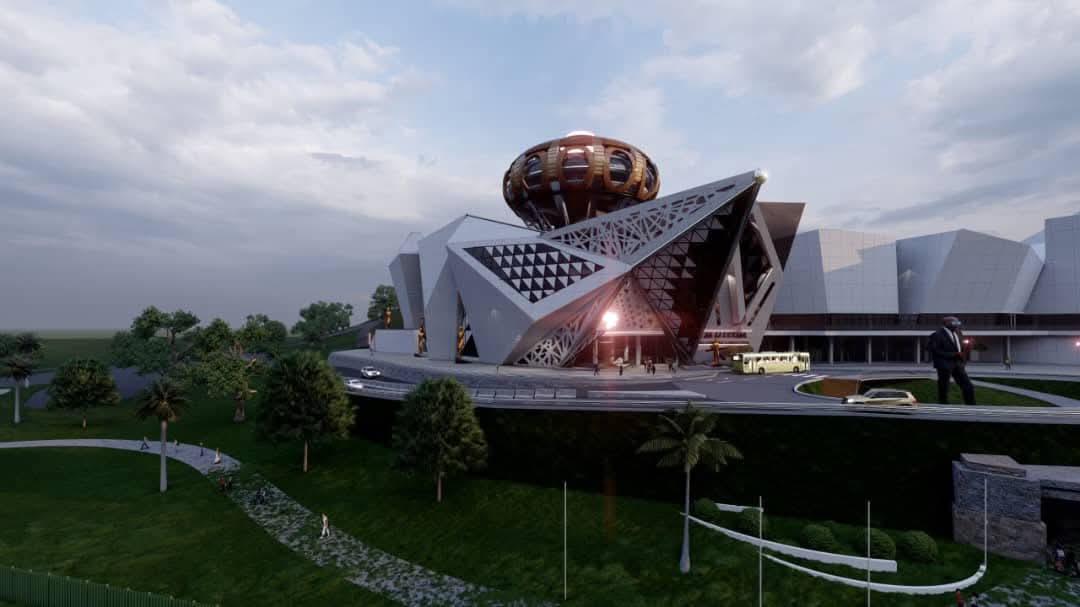

Zimbabwe’s construction sector, like any other, faces a multitude of risks, from fluctuating material costs and labor shortages to unforeseen site conditions and potential project delays. Managing these risks effectively is crucial for the success and sustainability of any construction project. This is where the strategic interplay of insurance and banking becomes paramount. These two sectors, often viewed as separate entities, can work synergistically to provide a robust framework for risk mitigation and financial security.

Insurance, in its various forms, acts as a safety net, protecting construction businesses from potential financial losses. Public liability insurance, for instance, covers damages to third-party property or injuries on site, safeguarding the business from potentially crippling lawsuits. Contractors’ all risks insurance protects the project itself from damage due to fire, theft, or natural disasters. Workers’ compensation insurance covers medical expenses and lost wages for employees injured on the job, ensuring compliance with labor laws and protecting the workforce. These are just a few examples of how insurance can shield construction projects from unforeseen events.

Banking, on the other hand, provides the financial fuel that drives construction projects. From securing initial funding to managing cash flow throughout the project lifecycle, access to banking services is essential. However, securing project financing can be challenging, particularly for smaller or newer construction firms. This is where the synergy between insurance and banking becomes particularly evident.

Surety bonds, a type of insurance, play a crucial role in securing project financing. A surety bond guarantees that a project will be completed even if the contractor defaults. This assurance significantly reduces the risk for banks and other lenders, making them more willing to provide financing. The bond acts as a form of collateral, demonstrating the contractor’s commitment and financial stability. This, in turn, makes it easier for construction companies to access the necessary funds to undertake projects.

Beyond surety bonds, a sound insurance portfolio can enhance a construction company’s financial standing, making it more attractive to lenders. Demonstrating comprehensive insurance coverage signals responsible risk management and financial prudence, increasing the likelihood of securing favorable loan terms and interest rates. Furthermore, effective risk management through insurance can minimize potential losses, preserving the company’s capital and improving its overall financial health.

In the Zimbabwean context, where access to finance can be a significant hurdle for construction businesses, understanding and leveraging the complementary roles of insurance and banking is crucial. Strategically integrating these two elements, enable construction companies to not only mitigate risks but also enhance their financial credibility, paving the way for sustainable growth and success in a competitive market. This integrated approach allows businesses to navigate the complexities of the construction landscape with greater confidence and financial security.