By Martin Chemhere

Kura Chihota, a Zimbabwean seasoned property consultant with 30 years of experience, recently launched a proactive campaign to expand his business in the Southern African Development Community (SADC) region as 2025 begins.

Using the moniker “#MoneyIsMoving,” Chihota is positioning himself as a key player in providing “intelligently curated solutions to the built environment.” His outreach, primarily conducted on X (@KuraChihota), targets individuals and organizations seeking to navigate the complexities of regional real estate.

Chihota’s expertise spans a wide range of property-related services, including consulting, agency, asset management, portfolio strategy formulation, and REIT (Real Estate Investment Trust) formulation and management. He emphasizes his commitment to helping clients achieve higher incomes and protect or grow their wealth through strategic property investments.

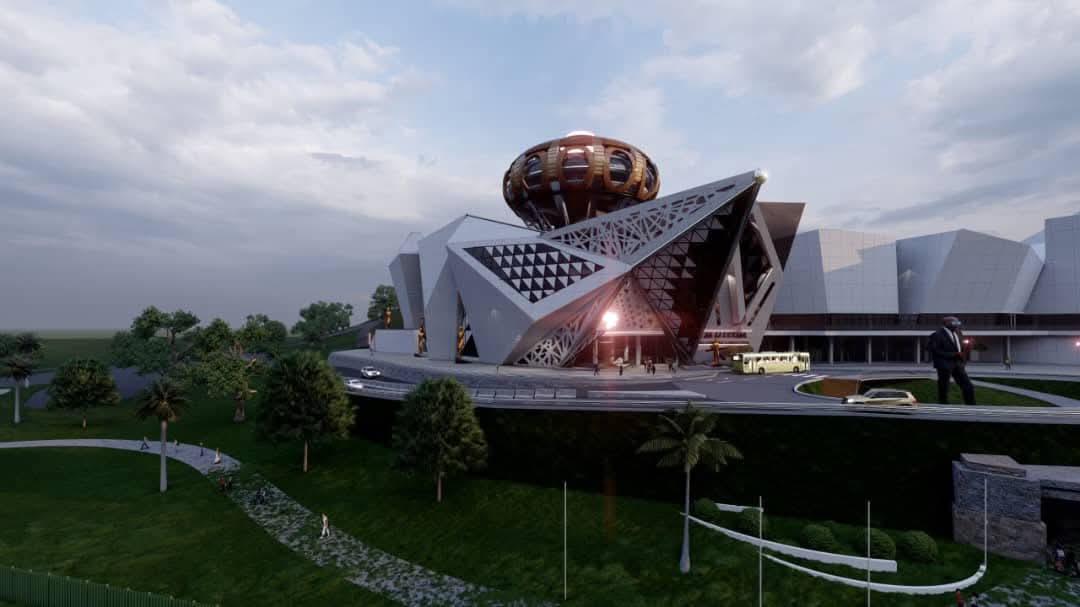

His focus extends across the SADC region, with a particular emphasis on South Africa, specifically Johannesburg (JHB) and Cape Town. He highlights the availability of properties ranging from R200,000 in Johannesburg CBD to R15 million in Cape Town’s City Bowl, showcasing the diverse investment opportunities available.

Chihota explicitly invites Zimbabwean investors (“Zimbo’s”) to participate in the South African market, assuring them of his support in navigating the process. He offers end-to-end services, from sourcing properties and developing investment plans to mortgage origination and tenant placement.

The context of real estate in Zimbabwe and South Africa provides a backdrop for Chihota’s endeavors. Zimbabwe’s real estate market has faced significant challenges in recent years, including economic instability, currency fluctuations, and hyperinflation. This has led to uncertainty and volatility in property values, making informed investment decisions crucial.

While there have been periods of growth, the market remains susceptible to macroeconomic factors. This environment creates a demand for experienced consultants like Chihota who can provide expert guidance and navigate these complexities.

In contrast, South Africa’s real estate market, particularly in metropolitan areas like Johannesburg and Cape Town, is more established and diverse. Johannesburg, as the economic hub of South Africa, boasts a robust commercial property sector and a diverse residential market catering to various income levels.

Cape Town, known for its scenic beauty and tourism industry, attracts both local and international investors, particularly in the high-end residential and hospitality sectors. The property markets in these cities are influenced by factors such as interest rates, economic growth, and demographic trends.

Chihota’s targeting of both Zimbabwean and South African markets reflects an understanding of the interconnectedness of the SADC region. Zimbabwean investors may seek opportunities in the more stable South African market, while South African investors may benefit from his regional expertise and network.

His emphasis on end-to-end services, including mortgage origination and tenant placement, addresses the practical challenges of cross-border property investment.

Chihota’s use of social media and direct engagement (“DM open”) demonstrates a modern approach to business development. His way of dealing with his target market to actively promote his services and expertise, aim to connect with potential clients and establish himself as a trusted advisor in the regional property market. His call for “edifying discussions” and solutions to property problems underscores his commitment to providing value beyond simple transactions.