The primary objective of the Infrastructure and Development Bank of Zimbabwe (IDBZ) is to secure funding and allocate it to critical infrastructure initiatives that require medium to long-term financing.

Recognizing the importance of housing and longevity in driving economic growth, development, and reducing poverty, the recently renamed Infrastructure and Development Bank places great emphasis on these factors.

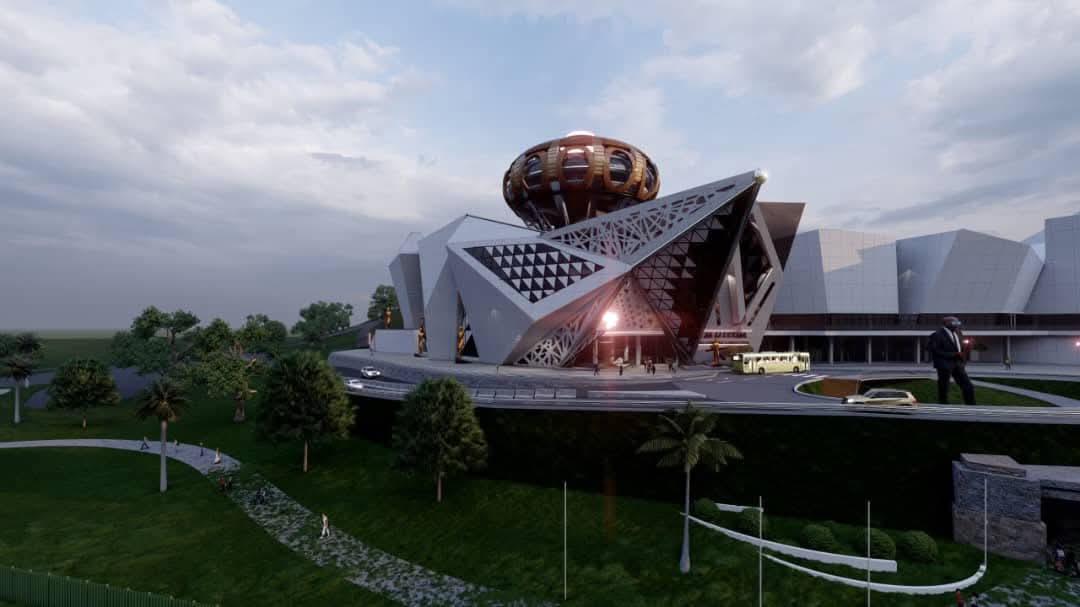

In a tweet on X, Zondo T. Sakala, IDBZ Chief Executive Officer, wrote: “One of 3 demonstration units at our Kadoma Cluster Development. A total of 30 units to be constructed before end 2024”.

The Kadoma project is part of the IDBZ’s on-going significant progress in implementing crucial infrastructure initiatives nationwide. Notable among these endeavours are the Bulawayo Students Accommodation Complex (BSAC), a US$3.8 million project dedicated to offering affordable housing to students, and the ongoing Waneka Phase Three housing development in Graniteside, Harare.

In 2021, the bank secured funding for two projects. The Rooiport Housing Project in Chivhu necessitates a sum of US$5.8 million, while the completion of the Lupane Students Accommodation Complex Project (LUSAC) calls for US$17.9 million.

The demand for housing in Zimbabwe, particularly in Harare, is overwhelming, with a backlog of over half a million units. Furthermore, the shortage of accommodation extends to state universities and other higher learning institutions, affecting both students and staff members.

Developmental financial institutions have seized the opportunity to provide funding for these projects, thereby helping to bridge the deficit.

During the six-month period under review, the bank’s project pipeline saw significant growth with the addition of new projects worth a total of US$26.3 million. Notable projects in this pipeline include the Tjindule Cluster Homes and solar system valued at US$7.2 million, the Selbourne Hostels worth US$0.25 million, and the Killarney Cluster Homes and Plumtree Plaza valued at US$4 million and US$4.85 million, respectively.

In the first half of 2022, the bank secured new projects worth US$26.3 million, further strengthening its already impressive project pipeline.

By last year, the bank had provided financial support for various projects, ranging from student accommodation at Chinhoyi University of Technology to housing schemes in Plumtree, Gwanda, Harare, Kadoma, Lupane, and Kwekwe.

The bank aims to enhance the quality of life for Zimbabweans by investing in infrastructure and addressing sector deficiencies, thereby promoting sustainable economic growth.