More than any period in the life of Citizenship-by-investment (CBI) programmes, the last few years have emphasised the need for this significant non-tax revenue source for East Caribbean Island economies. The five countries in the region which offer citizenship by investment programmes primarily rely on tourism receipts to fund government operations. However, due to the pandemic commercial aircraft were grounded globally with the consequence that tourism revenue was zero. For these small island nations, the governments were able to meet most of their financial obligations from the revenue generated through their respective CBI programmes.

More than any period in the life of Citizenship-by-investment (CBI) programmes, the last few years have emphasised the need for this significant non-tax revenue source for East Caribbean Island economies. The five countries in the region which offer citizenship by investment programmes primarily rely on tourism receipts to fund government operations. However, due to the pandemic commercial aircraft were grounded globally with the consequence that tourism revenue was zero. For these small island nations, the governments were able to meet most of their financial obligations from the revenue generated through their respective CBI programmes. Citizenship by investment programmes offers families and individuals the opportunity to acquire a second citizenship, which grants them the right to travel freely to various countries and settle in another country. Over 100 countries have CBI programs in place, and EC Holdings has selected the most beneficial and successful programs.

Over the past seven years, in the case of Antigua & Barbuda and Grenada, and for more than a decade in the case of Dominica and St Kitts and Nevis, CBI programmes have played an increasingly vital role in the fiscal life of these countries. It is estimated that CBI contributes upwards of 40 percent of Dominica’s and St Kitts’ GDP and 10 to 15 percent of Antigua’s, Grenada’s and St Lucia’s. The funds are also used to support much-needed social programmes and the budgets of some government departments, including social security and pension disbursements.

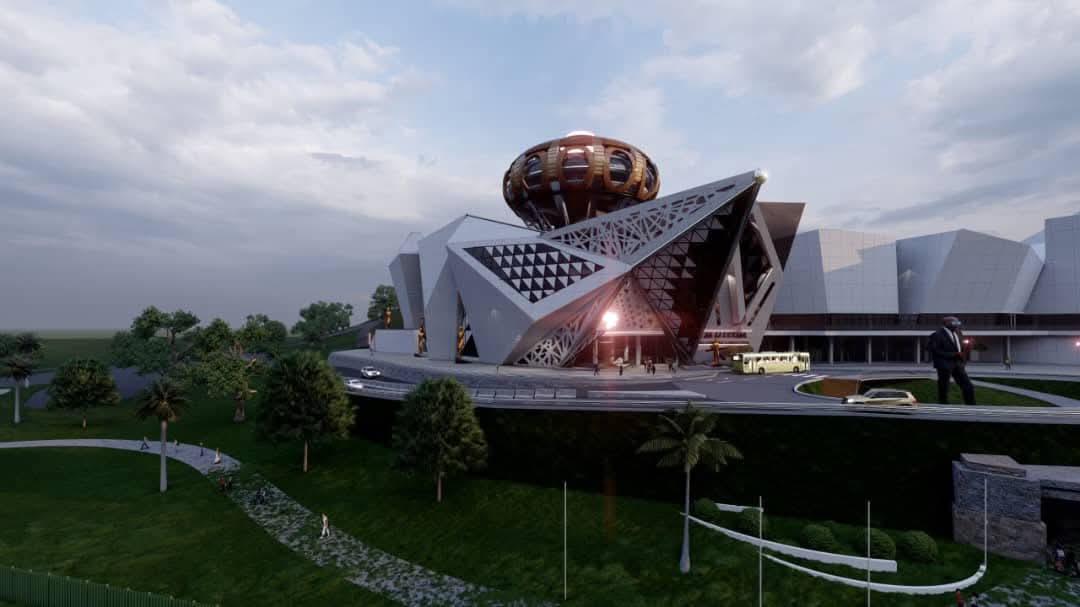

Apart from the direct cash that flows to the government, the programmes also contribute to the economy through real estate and construction projects, supporting the maintenance of existing jobs and creating new ones in those sectors. Following the 2008 global meltdown caused by the collapse of the USA sub-prime mortgage fiasco, financial institutions shifted from lending to hotel projects in the Caribbean region. Financing for such projects largely dried up as a result. Currently, 99 percent of hotels being constructed, renovated, refurbished or expanded are doing so under CIP/CBI. In St Kitts, there are over 120 approved developments, whilst in Antigua, that number is more than 40. In Grenada, there are more than 20 approved developments; in Dominica, ten, and in St Lucia two. It is reasonable to deduce that these projects would not have been possible without the existence of citizenship by investment.

For several years, Antigua and Barbuda had a thriving online gaming sector, employing thousands of locals in full-time and part-time jobs, which fostered a budding middle class. In time, the US enacted legislation making it illegal to use US-based financial services such as credit cards to pay for online betting. This caused the industry’s demise, with some operators closing their businesses and others moving to different jurisdictions outside of the Caribbean. Needless to say, many individuals lost their primary income or secondary income. Antigua and Barbuda, for instance, was able to provide more than 3,000 relatively high-paying jobs during the peak of the gaming industry; more than 90 percent of these jobs were lost, resulting in a severe impact on the middle class.

Another service sector that was for the most part wrecked by the actions of external forces is the offshore banking sector. Here again, thousands of families relied on the income from full-time jobs, which disappeared over an abbreviated period of time. Currently, there are only a handful of offshore banks operating in Antigua and Barbuda.

Additionally, these small island developing states (SIDS) do not have raw materials or commodities that they can trade; hence, their economies are largely dependent on tourism, together with the service sectors.

It is undeniable that the hundreds of millions of dollars generated by the CIP/CBI programmes provide vital support to governments to assist with recurrent expenditures, meet loan payments, and support infrastructure development and capital projects. I am willing to listen to alternative solutions to meet this funding gap. Given the above, it should become evident that the survival of these programmes is essential to the viability of these economies.

With the world increasingly interconnected and people seeking more opportunities, CBI programs are becoming more popular. EC Holdings provides answers to the most common questions about acquiring second citizenship and details of the most exciting citizenship solutions around the world. Find out more by visiting the online portal www.ec-holdings.com. EC Holdings is a licensed agent and authorized representative of the Citizenship by Investment Program of Antigua and Barbuda, which was launched in 2013. The program offers visa-free travel to 150 countries, including the UK, Schengen Area, Singapore, Hong Kong, South Korea, Russia and Qatar.

Text by EC Holdings

From: S&D ISSUE 60