By Martin Chemhere

In Zimbabwe, where economic fluctuations and limited access to formal housing finance have often presented challenges to homeownership and maintenance, home improvement loans have emerged as a crucial tool for homeowners. These loans, specifically designed to finance renovations, repairs, and extensions, play a vital role in preserving housing stock, improving living standards, and stimulating local economies.

For many Zimbabweans, building a home is a long-term aspiration, often achieved incrementally over many years. Home improvement loans provide the necessary financial boost to complete unfinished projects, such as adding a bedroom, installing a new roof, or upgrading plumbing and electrical systems. This is particularly relevant in high-density suburbs like Budiriro or Glen View, where many houses are built in phases as families accumulate resources. A home improvement loan can enable a family to finally complete their home and create a more comfortable living space.

Beyond completing unfinished projects, these loans are essential for maintaining existing properties. Zimbabwe’s climate, with its harsh summers and rainy seasons, can take a toll on buildings. Roof leaks, cracked walls, and damaged plumbing are common issues that require timely repairs. Home improvement loans provide access to funds for these necessary maintenance works, preventing further deterioration and preserving the value of the property. For example, a homeowner in Borrowdale might use a loan to replace a damaged roof after a heavy storm, preventing costly structural damage in the long run.

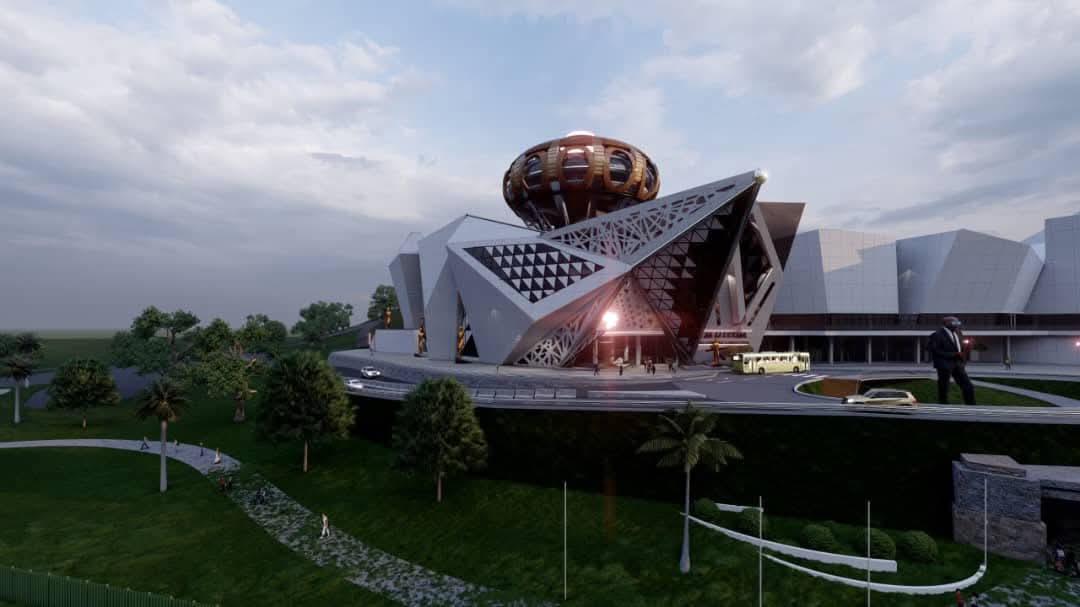

Moreover, home improvement loans contribute significantly to local economies. The funds disbursed through these loans are often injected directly into the local construction sector, creating demand for building materials, hardware supplies, and skilled labour. This stimulates economic activity at the grassroots level, supporting small businesses and creating employment opportunities for builders, plumbers, electricians, and other tradespeople. Consider a case study where a group of homeowners in Chitungwiza accessed home improvement loans. The increased demand for building materials would likely benefit local hardware stores and create jobs for local builders and artisans within the community.

Access to home improvement loans also improves living standards and public health. Upgrading sanitation facilities, installing proper ventilation, and addressing dampness can significantly improve indoor environmental quality and reduce the risk of health problems. In densely populated areas like Mbare, improving sanitation through home improvement loans can have a positive impact on public health by reducing the spread of diseases.

However, challenges remain. Access to affordable home improvement loans can still be limited, especially for low-income households and those without formal employment. The availability of long-term, low-interest loans is crucial for maximizing the impact of these financial products. Furthermore, financial literacy programs that educate homeowners about responsible borrowing and budgeting are essential for ensuring that these loans are used effectively.

Home improvement loans play a vital role in the Zimbabwean context. They facilitate the completion of homes, enable essential maintenance, stimulate local economies, and improve living standards. Addressing the challenges related to access and affordability, these loans can continue to empower homeowners and contribute to the overall development of the country.