Fidelity Life Asset Management has announced the launch of a Real Estate Investment Trust (REIT) called the Eagle Fund. The aim of the fund is to raise around US$60 million, which will be invested in the development of medical, hospitality, and residential facilities in Victoria Falls, Mazowe, and other areas.

The Fund is expected to have a positive impact on the infrastructure development in these areas across the country. Investors will receive units in the trust and as beneficiaries of the trust, they will share in the profits or income from the real estate assets owned by the trust.

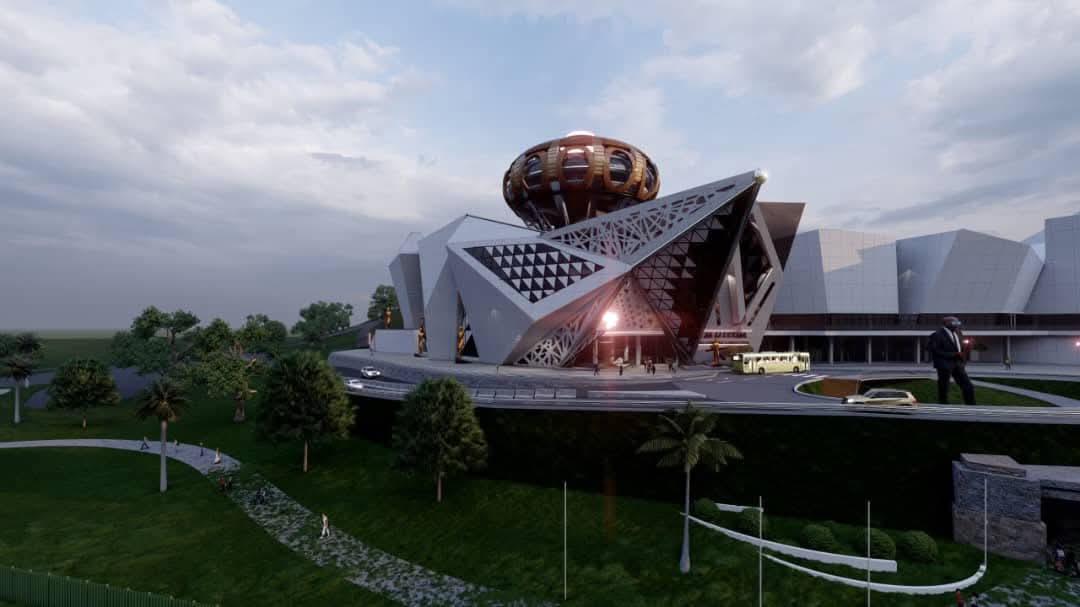

During an interview at the investor engagement workshop in Bulawayo, Mr Berven Ngara, the managing director of Fidelity Life Asset Management, revealed that plans are underway to develop a new property in Victoria Falls. The property will include a 32-bed hospital operated by Heath Share from South Africa, a hotel operated by Arco Hotels, and 154 residential townhouses and apartments on approximately 12.3 hectares of land.

In Mazowe, a retail complex will be constructed to house a medical facility as well as residential space, while in Mutare, Fidelity Life is converting an already existing building into a hotel which will have about 120 to 130 rooms.

The Eagle Fund will be listed on the Victoria Falls Stock Exchange in United States (US) dollars and will generate predominantly US dollars. The REIT will pay at least 80 percent of its attributable profits as dividend every year and will pay a quarterly dividend.

This is different from existing REITs. Fidelity Life Asset Management is currently doing private placement to meet stakeholders and the investment community to bring them on board during this development stage, which has a development profit of about 15 percent.

Mr Ngara said they will continue to meet investors in Harare, Victoria Falls, and other parts of the country to list at VFEX in the fourth quarter of this year. After private placement, an initial public offering and listing on the VFEX are expected. The target is to raise about US$17 million this year, and US$9.4 million of this amount has already been raised.

In Zimbabwe, REITs were introduced in 2019 as regulated investment vehicles to enable collective investment in real estate. These trusts pool investors’ funds, divide them into units, and distribute profits from real estate assets to beneficiaries.

Real Estate Investment Trusts (REITs) offer several advantages for investors. They provide diversification by investing in multiple real estate properties, resulting in stability. Additionally, REITs offer above-average dividend yields, making them an attractive choice for passive income. Most REITs trade on public exchanges, providing liquidity and consistent cash flow.

From: S&D ISSUE 64