By Martin Chemhere

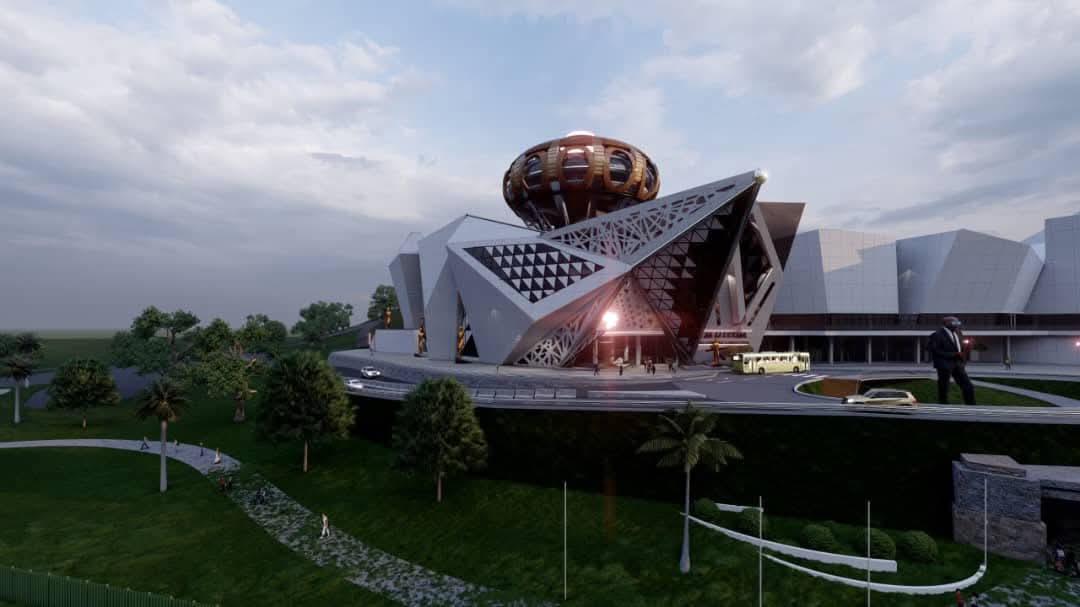

The National Social Security Authority (NSSA) has a diverse investment portfolio that includes a significant number of commercial properties. These properties range from shopping centers and office buildings to hotels and residential complexes.

Some of the flagship properties in the NSSA portfolio include the NSSA Harare and Social Security Centre, which are prominent office buildings in the capital city. The portfolio also boasts several shopping centers located in different parts of the country, such as the Chipinge Shopping Centre (Chipinge), Pomona Shopping Centre (Borrowdale, Harare), and Gwanda Shopping Mall (Gwanda). These centers provide retail space for a variety of businesses and serve as important commercial hubs in their respective locations.

In addition to shopping centers and office buildings, NSSA has also invested in other types of properties. Celestial Park (Borrowdale), for instance, is a mixed-use development that includes office space, retail space, and residential units. St Tropez Apartments (Eastleigh) is another residential property in the portfolio, offering housing options in a desirable location. The Beitbridge Hotel (Beitbridge) is a hospitality investment that caters to travelers and visitors in the border town of Beitbridge. These diverse property investments demonstrate NSSA’s strategy of diversifying its portfolio across different sectors and geographic areas.

Overall, NSSA’s property investment portfolio comprises a total of 111 properties. This includes a variety of assets such as shopping malls, land banks, hospitals, hotels, and infrastructure projects. The portfolio also includes an investment in Dubury Investments, which owns Joina City, a prominent shopping mall in Harare.

Through its property investments, NSSA aims to generate income and contribute to the growth of the economy while also providing social security benefits to its members. The diverse nature of the portfolio helps to mitigate risk and ensure a steady stream of returns for the organization.